Congress returns next week to address an imminent government shutdown. Unless the House and Senate pass a long-term budget or short-term stopgap by March 1, 20 percent of funding for the current fiscal year will expire – with remaining federal operations potentially ceasing on March 8. (Forbes | (Politico, Feb. 21)

Funding Negotiations

- Policy riders on issues such as abortion, gender-affirming care, and medical research remain contentious issues.

- Axios reported this week that House Republicans expect some version of a shutdown before passing a new funding bill. Congress has approved three continuing resolutions since Sept. 30 to keep the government open with current funding in place, as a full budget for the fiscal year ending Sept. 30 remains elusive. (Committee for a Responsible Budget, Feb. 13)

- Congress must also take into account a key date of April 30, when a 1 percent cut in all federal funding (including Pentagon programs) will take effect without passage of fiscal legislation. (Federal News Network, Dec. 26, 2023)

Pending Tax Package

- A bipartisan $79 billion tax package that was overwhelmingly approved by the House on Jan. 31faces potential hurdles in the Senate. The bill contains Roundtable-supported measures on business interest deductibility, bonus depreciation, and the low-income housing tax credit (LIHTC). (Roundtable Weekly, Feb. 2 and Jan. 19)

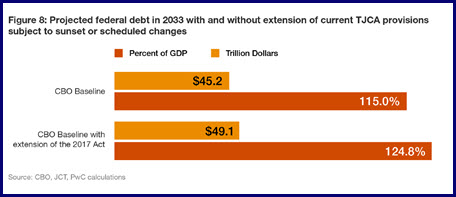

- Leading congressional tax writers are considering adding the House-passed tax package to a potential spending bill. House Ways and Means Committee Chair Jason Smith [R-MO] recently told Axios that he is meeting with Republican senators to pass the limited tax extenders package as a prelude to next year’s effort on whether to extend tax cuts passed in 2017 as part of the Tax Cuts and Jobs Act. (TaxNotes Talk podcast, Feb. 21)

- Smith commented, “For one it breaks the dam. There has not been any kind of even a small extenders package passed in three years and let alone in divided government. And so 2025 is the Super Bowl of tax.” (Axios, Feb. 16)

“Yes in My Backyard” Coalition

- This week, The Real Estate Roundtable and 21 other national organizations expressed their strong support for the bipartisan Yes in My Backyard Act (YIMBY) in their latest letter to the House Financial Services Committee (Coalition letter, Feb. 20)

- H.R. 3057, introduced by Congressmen Mike Flood (R-NE) and Derek Kilmer (D-WA), would help promote development of affordable housing by requiring local governments that receive certain federal grants to report on their practices to support high-density development.

- Separately, the Wall Street Journal (Feb. 20) highlighted that community opposition to new projects is not just restricted to housing developments. E-Commerce hubs are also “increasingly contending with a headache” of NIMBY sentiments, as developers of warehouse and logistics properties face the conundrum of siting projects that are necessary to deliver goods to residents and consumers.

SEC & Scope 3 Disclosure

- Reuters (Feb 23) reports that the U.S. Securities and Exchange Commission (SEC) plans to eliminate requirements for companies to report on Scope 3 “value chain” emissions in its imminent climate risk disclosure rule. (Roundtable Weekly, Feb. 16). RER’s 2022 comments in fact urged the Commission to drop its “back door mandate” for Scope 3 disclosures. (Roundtable Weekly, June 10, 2022)

The SEC must still vote on the final regulation before its release. Progressive Democrats in Congress will likely object to any rule that relieves registered companies from Scope 3 reporting.

# # #