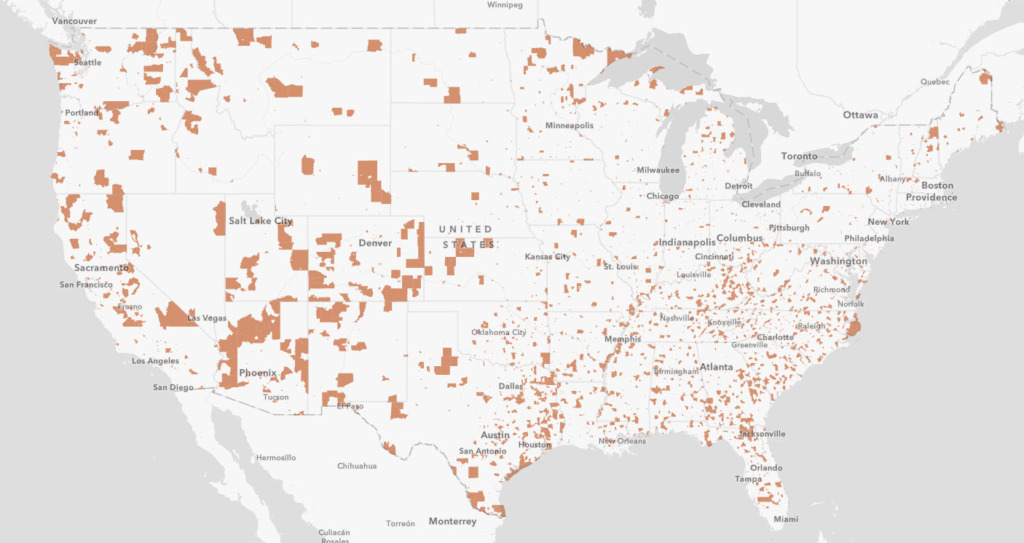

The Treasury Department and Internal Revenue Service (IRS) this week issued Notice 2025-50, providing guidance on Opportunity Zone (OZ) investments in rural areas under the One Big Beautiful Bill (OB3) Act. The notice designates 3,309 census tracts—about 38% of the OZ map—as rural, giving investors and developers clarity on how the new rules apply. (IRS, Sept. 30)

New Guidance

- Rural definition: Any census tract outside a city or town with a population greater than 50,000—and not an adjacent urbanized area—qualifies as rural. (BisNow, Oct. 1)

- 3,309 tracts designated: The notice identifies 3,309 rural OZ census tracts, representing about 38% of all OZs designated in 2018.

- Lowered improvement threshold: Effective July 4, 2025, real estate projects in rural OZs must meet a more manageable 50% substantial improvement test—down from 100%—to qualify for OZ tax benefits. The substantial improvement test governs the level of new investment required, relative to the cost of the property.

- The guidance applies only to the current OZ map. Treasury said definitions for future OZ designations, which will take effect in 2027, will be addressed separately. (PoliticoPro, Sept. 30)

- The latest guidance enhances certainty for investors and developers seeking to expand housing and economic opportunity in rural America.

Roundtable Advocacy

- The Real Estate Roundtable (RER) has long championed OZs as a transformative tool to drive economic growth and increase affordable housing in underserved communities. (Roundtable Weekly, April 4)

- RER members have used OZ capital nationwide to finance multifamily housing, mixed-use developments, and life sciences facilities that support job creation and local tax revenues.

- The OB3 Act permanently extended OZ tax incentives and enacted key reforms. (OB3 Act Fact Sheet):

- At the American College of Real Estate Lawyers (ACREL) Annual Meeting recently, RER President and CEO Jeffrey DeBoer and SVP & Counsel Ryan McCormick addressed the enhanced role of OZs in revitalizing communities. (Watch Video)

- This week, RER’s Opportunity Zone Working Group met virtually with staff from Sen. Tim Scott (R-SC) office, the leading Congressional sponsor and advocate of OZs, to discuss next steps in the implementation of the OZ reforms and enhancements.

Why It Matters

- Since 2017, OZs have spurred more than $120 billion in investment—much of it directed toward new housing, helping to expand supply, create jobs, and revitalize economically distressed areas. (RER Annual Report 2025)

- Housing impact: OZs accounted for 20% of all new multifamily units in 2023, up from 8% when the program began. (ULI, Sept. 22)

- Economic impact: OZ incentives nearly doubled housing production in designated tracts from 2019 to 2024, generating more than 313,000 new residential addresses at relatively low fiscal cost. (Economic Innovation Group, March 11)

RER’s Tax Policy Advisory Committee (TPAC) and Opportunity Zone Working Group will continue to evaluate OZ changes, address technical issues, and ensure the industry’s voice is heard as Treasury and IRS implement the new law.