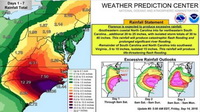

As Hurricane Florence made landfall this morning near Wrightsville Beach, NC, the storm’s large size and slow speed are expected to produce severe flooding, affecting millions of individuals who have evacuated affected coastal areas and thousands of businesses in the Carolinas. (National Hurricane Center, Hurricane Florence)

|

|

As communities in the Carolinas and beyond contend with catastrophic storm surge, rain deluge, high winds and loss of property, Real Estate Roundtable President and CEO Jeffrey DeBoer expressed concern about the disaster and its victims, encouraging those in the industry to participate in relief efforts. |

- Today, President Trump announced more than 3,800 Federal Employees, including more than 1,000 from the Federal Emergency Management Agency (FEMA), are working with State and local partners to respond to Hurricane Florence. (White House Statement, Sept. 14)

- In the wake of last year’s Hurricane Harvey disaster in Texas, policymakers in Washington are again expected to appropriate disaster relief this fall and address legislation reforming the National Flood Insurance Program (NFIP), scheduled to expire on Nov. 30. (Roundtable Weekly, Sept. 8, 2017)

- As communities in the Carolinas and beyond contend with catastrophic storm surge, rain deluge, high winds and loss of property, Real Estate Roundtable President and CEO Jeffrey DeBoer expressed concern about the disaster and its victims, encouraging those in the industry to participate in relief efforts.

- DeBoer stated, “Action is needed to help assist families today and help facilitate recovery for the future. For our part, members of The Real Estate Roundtable, and everyone involved in the broader real estate industry, should do what they can to provide immediate assistance. The National Voluntary Organizations Active in Disaster (NVOAD) lists organizations where you can donate time, money or other resources.”

- “The Real Estate Roundtable has also activated our industry public-private information sharing partnership with the federal government (Real Estate Information Sharing and Analysis Center – REISAC) in an effort to provide ongoing industry updates on a range of critical matters arising from Florence’s landfall – such as search and rescue efforts by the National Guard; anticipated flooding in communities as the storm’s impact moves eastward; refuge information provided by the Red Cross; energy disruptions; and phishing scams on social media,” added DeBoer.

- As legislation moves on Capitol Hill this fall to extend and reform the NFIP, The Roundtable plans to advocate for reforms that will assist housing re-development in flood-prone areas; help protect the nation’s commercial and multifamily business-owners, their properties, and residents; and foster resilient and cost-effective infrastructure.

President Trump announced more than 3,800 Federal Employees, including more than 1,000 from the Federal Emergency Management Agency (FEMA), are working with State and local partners to respond to Hurricane Florence. (White House Statement, Sept. 14)

- The Roundtable has also advocated for a voluntary exemption for mandatory NFIP coverage if commercial property owners have adequate flood coverage.

- Under the NFIP, commercial property flood insurance limits are very low – $500,000 per building and $500,000 for its contents. Lenders typically require this base NFIP coverage, and commercial owners must purchase Supplemental Excess Flood Insurance for coverage above the NFIP limits. A niche market of carriers typically provides this type of excess coverage. The Roundtable and its coalition partners support NFIP reauthorization with the inclusion of provisions that permit the “commercial exemption.”

- The Real Estate Roundtable and 14 other industry groups urged Congress in a June 12, 2017 comment letter to reauthorize and reform the NFIP to help protect the nation’s commercial and multifamily business-owners, their properties, residents, and the jobs they create from the financial perils of flooding.

- In November 2017, the House passed the 21st Century Flood Reform Act (H.R. 2874), which would reform and reauthorize NFIP for five years. The bill included: funding for flood mitigation assistance; lower flood insurance rates, support for the private flood insurance market, modernization of flood zone mapping; and flood mitigation practices for homebuilders and land developers. However, the measure was not been taken up in committee in the Senate. ( Roundtable Weekly, Nov. 17, 2017)

The Roundtable will continue to work closely with lawmakers and our coalition partners to ensure that the NFIP is renewed prior to its expiration date on Nov. 30, 2018.