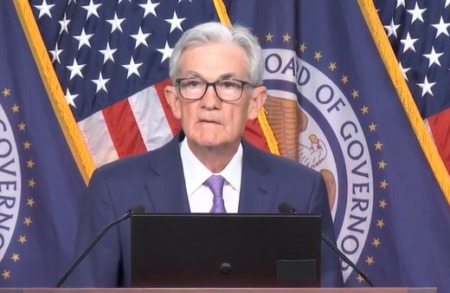

The Federal Reserve’s Federal Open Market Committee voted unanimously this week to maintain the federal funds rate at the 5.25%-5.5% range where it has been since July of last year. (Federal Reserve Press Release)

Federal Open Market Committee (FOMC) Meeting

- After the meeting Wednesday, Fed chair Jerome Powell said at a news conference that he saw either one or two rate cuts this year as “plausible” scenarios. (Axios, June 12)

- “What everyone agrees on is it’s going to be data dependent,” Powell added.

- The FOMC issued a statement indicating that lowering inflation to 2 percent is their primary objective before reductions can occur.

- The Summary of Economic Projections (SEP) report released this week forecasted one rate cut in 2024, compared with three estimated in December 2023.

- The FOMC currently anticipates making four quarter-point cuts next year, bringing the federal funds rate down by 1.25 percentage points from its current level.

Congressional Pushback

- Senators Elizabeth Warren (D-MA), Jacky Rosen (D-NV), and John Hickenlooper (D-CO) wrote to Fed chair Jerome Powell, urging the Fed to cut the federal funds interest rates from its current, two-decade-high of 5.5 percent, citing that other major central banks around the globe have made cuts or are leaning toward lowering interest rates. (Press Release | Letter)

- Their letter also raises concerns that high interest rates are increasing the costs of housing and insurance, continuing to hurt Americans as rates remain unchanged.

- On housing prices, the senators wrote: “The country is already facing a severe housing shortage, and the Fed’s refusal to bring down interest rates is exacerbating this shortage and driving higher inflation rates…Lower mortgage rates would encourage more people to sell their homes, which would in turn increase housing supply, decrease prices, ease the costs of renting, and ultimately increase homeownership.”

- Sen. Sheldon Whitehouse (D-RI), chairman of the Senate’s Budget Committee, and Rep. Brendan Boyle (D-PA), ranking member of the House Budget Committee, also wrote to Chairman Powell echoing their concerns that high interest rates are exacerbating the housing supply crisis. (Letter)

Next week, at The Roundtable’s all-member Annual Meeting, we will hear economic and market forecasts from a panel of Roundtable members and Kenneth T. Rosen, Chairman, Fisher Center for Real Estate and Urban Economics at the Haas School of Business at the University of California, Berkeley; Chairman, Rosen Consulting Group.