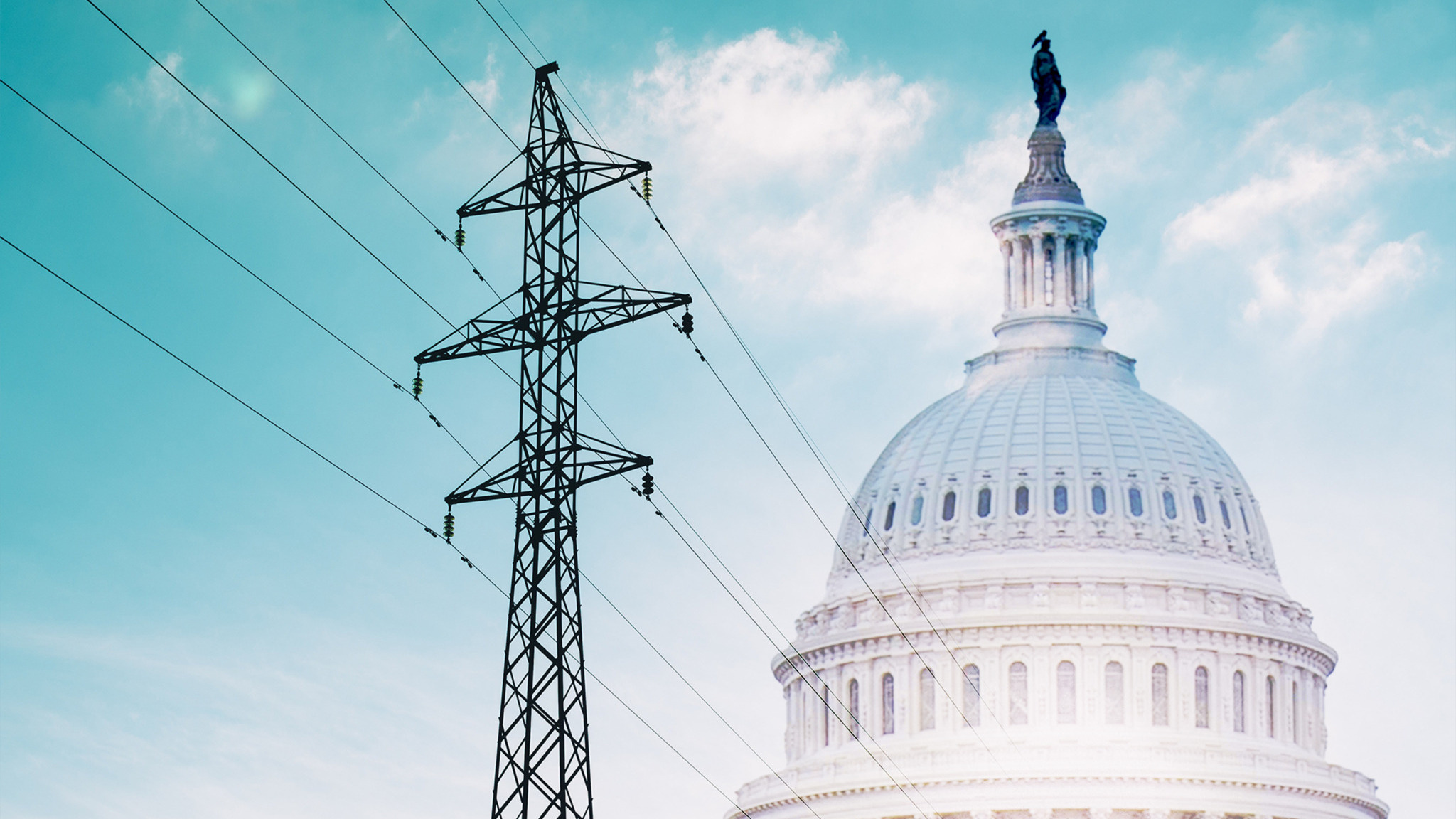

The U.S. House of Representatives passed the bipartisan SPEED Act (H.R. 4776) on Thursday by a 221–196 vote, advancing legislation aimed at streamlining federal permitting reviews to accelerate energy and infrastructure development amid surging electricity demand and rising power costs. (Axios, Dec. 18)

State of Play

- Sponsored by House Natural Resources Committee Chair Bruce Westerman (R-AR) and Rep. Jared Golden (D-ME), the SPEED Act would overhaul the National Environmental Policy Act (NEPA) by reducing duplicative reviews, curbing excessive litigation, and increasing certainty for large-scale grid improvements and other infrastructure development requiring federal approval.

- The House’s passage of the SPEED Act marks a significant step in a broader congressional push to modernize permitting rules and address long-standing bottlenecks slowing investments in power generation, transmission, and distribution projects.

- “For too long, America’s broken permitting process has stifled economic development and innovation,” Chair Westerman said following the vote. “This historic vote on the SPEED Act will fix the system by establishing the project certainty that’s currently lacking in the permitting process and allow America to build again.” (PoliticoPro, Dec. 18, Rep. Westerman Weekly Column, Dec. 19)

- 11 Democratic votes in favor of the measure demonstrated bipartisan momentum heading into Senate consideration.

- In the Senate, key negotiators acknowledged the House GOP’s internal challenges but welcomed the bill’s passage. Senate Environment and Public Works Chair Shelley Moore Capito (R-WV) said the House vote “will give us good momentum,” while Ranking Member Sheldon Whitehouse (D-RI) emphasized his focus on producing a bipartisan Senate bill. (PoliticoPro, Dec. 18)

- The Trump administration has expressed support for congressional action on permitting reform, but has not taken a position on the SPEED ACT. (PoliticoPro, Dec. 8)

Roundtable Advocacy

- Ahead of the procedural vote earlier in the week, The Real Estate Roundtable (RER) joined a broad business coalition led by the U.S. Chamber of Commerce in support of the SPEED Act. (Dec. 16 Letter)

- RER also wrote to congressional leadership last week, urging passage of the bill, citing the need to strengthen grid reliability, lower energy costs, and keep pace with rapidly rising electricity demand. (Letter, Dec. 8)

- In its letter, RER emphasized that the U.S. needs “as much electricity as possible, from as many sources as possible, delivered as quickly and cheaply as possible” to support economic growth, re-shore manufacturing, and maintain global competitiveness in artificial intelligence. (Roundtable Weekly, Dec. 12)

What’s Next

- The bill now heads to the Senate, where it is expected to spur broad cross-committee negotiations involving the Energy and Natural Resources Committee and the Environment and Public Works Committee. (Axios, Dec. 18)

- The House vote “doesn’t get any easier” for the SPEED Act to make it all the way through Congress, as the “political opening is extremely narrow” in the Senate. (Axios, Dec. 19)

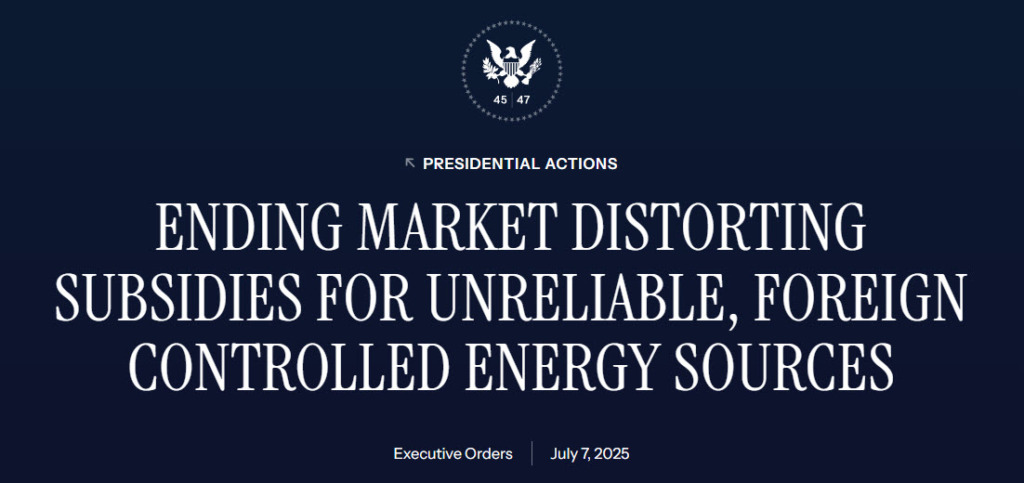

- The legislation faces opposition from some Senate Democrats who seek further protections to advance wind and solar development. At least seven Democrats would be needed to overcome a filibuster. (Bloomberg, Dec. 18)

- Despite divisions, several Senate Democrats have signaled interest in crafting a permitting compromise capable of securing the 60 votes required for passage. (Axios, Dec. 18)

Permitting reform will be a featured topic at RER’s next all-member State of the Industry Meeting on Jan. 21–22, 2026, in Washington, D.C., as policymakers consider strategies to accelerate energy infrastructure and support long-term economic growth.