This week’s flurry of key economic data offered mixed signals about the state of the economy and whether the Federal Reserve’s interest rate increases can slow inflation without causing a significant increase in unemployment—a “soft landing” that could prevent a full-blown recession before the mid-term elections. (The Hill, July 28)

Economic Slowdown & Inflation

- POLITICO described the week as a “Category 5 storm of economic news.” Developments included a drop in the consumer confidence index for the third straight month; an increase in the Fed funds rate by another 75 basis points; and a drop in the gross domestic product (GDP) at an annual rate of 0.9 percent.

- Additionally, the Commerce Department reported today that the personal consumption expenditures price index (PCE)—a key inflation gauge closely tracked by the Fed—rose 1.0% increase last month and increased 6.8% since last June, the largest spike since January 1982. (Reuters and CNBC, July 29)

- President Biden responded, “It’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation.” (White House statement, July 28)

- Fed Chair Jerome Powell commented after the increase in interest rates. “I do not think the U.S. is currently in a recession. And the reason is there are just too many areas of the economy that are performing too well. The labor market has remained extremely tight, with the unemployment rate near a 50-year low, job vacancies near historical highs, and wage growth elevated. We think there’s a path for us to be able to bring inflation down while sustaining a strong labor market.” (Federal Reserve press conference transcript, July 27)

- The recent rise in interest rates are starting to hamper commercial real estate transactions and values. The Wall Street Journal reported on July 26 that “banks are lending less and charging higher interest rates for the loans they make to owners and buyers of office buildings, shopping centers and other commercial real estate.”

GDP & Jobs

- Treasury Secretary Janet Yellen yesterday addressed this week’s drop in GDP. “Most economists and most Americans have a similar definition of recession: a broad-based weakening of our economy. That is not what we’re seeing right now.” She added, “Job creation is continuing, household finances remain strong, consumers are spending, and businesses are growing.” (Treasury Department press conference transcript, July 28)

- Two straight quarters of economic contraction is usually considered a “technical” recession. Yet The National Bureau of Economic Research (NBR), as the official designator of recessions, has not released a decision yet based on the recent economic data. NBR bases its analysis of a wide variety of economic indicators such as employment, personal income, durable goods, housing permits, and other factors. (The Washington Post, July 27 and CNBC, July 26)

- White House economist Brian Deese commented on NBR and this week’s economic data on CNBC yesterday. “We’re certainly in a transition and we are seeing slowing as we all would have expected,” Deese said, “but if you look at the full data and the type of data that NBR looks at, nothing signals that this period in the second quarter is recessionary in the labor market.” (CNBC, July 28)

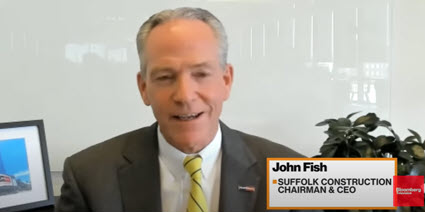

Roundtable Chair John F. Fish (Chairman & CEO, Suffolk), above, was interviewed July 27 on Bloomberg Markets: Americas about current economic conditions and real estate. He commented on the industry’s challenges, including fractious land use policy, supply shortages, and cost drivers. National economic conditions affecting CRE and the Fed’s monetary policies will be a focus during The Roundtable’s Fall Meeting on Sept. 21-22 in Washington, DC.

# # #