One of the commissioners from the Securities and Exchange Commission (SEC) and two U.S. Senators suggested this week that further analysis may be needed for a highly anticipated SEC rule on climate reporting, which includes a proposal for sweeping disclosures on Scope 3 GHG emissions. (Bloomberg Law, Nov. 7 | SEC headquarters in Washington, DC, above)

Stakeholder Comments

- Given that the SEC has received more than 16,000 stakeholder comments on the proposal, Republican SEC Commissioner Mark Uyeda said, “Before the Commission adopts any final rule that significantly deviates from the proposal, it should seriously consider re-proposing the rule with revised rule text and an updated economic analysis.” (Ayuda’s comments, Nov. 7 and The Hill, April 6)

- SEC Chair Chair Gary Gensler indicated in March that the agency’s climate-related reporting rule may be scaled back. (CNBC, March 7 and Roundtable Weekly, March 10)

Senators Support Additional Feedback

- Sens. Bill Hagerty (R-TN) and Joe Manchin (D-WV) also expressed support this week for obtaining additional feedback about the SEC’s proposed rule. Sen. Manchin chairs the Senate Energy and Natural Resources Committee and Sen. Hagerty serves on the Senate Banking Committee. (Hagerty-Manchin letter and PoliticoPro, Nov. 9)

- The lawmakers wrote to SEC Chairman Gary Gensler about recent California state laws that require companies to disclose their emissions, which beat the SEC to the punch on releasing final climate reporting rules. (Roundtable Weekly, Sept. 22 and The Real Estate Roundtable’s summary of the California legislation.)

- The Senators’ letter states, “The interconnectedness of the California requirements and the SEC’s proposal is undeniable: thousands of businesses would end up being subject to both the California requirements and the SEC’s rule, if finalized. However, key differences between the two raise significant compliance questions that the SEC should thoroughly review.”

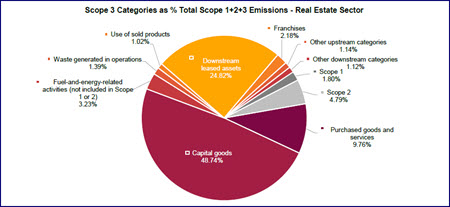

Roundtable Comments on Scope 3

- Scope 3 refers to indirect emissions that are part of an organization’s value chain but not owned or controlled by the reporting company. The 2022 SEC proposal would require corporate issuers of securities to estimate and report Scope 3 emissions “if material” in 10-Ks and other filings. (SEC News Release, March 22, 2022)

- Roundtable comments submitted in June 2022 emphasized that the SEC’s proposed directive, which would mandate that companies report on Scope 3 emissions “only if material,” is a “back-door mandate” that should be dropped. The comment letter added, “No registrant should be effectively required to report on indirect emissions beyond its organizational or operational boundaries.” (Roundtable Weekly, June 10, 2022),

The Roundtable’s Sustainability Policy Advisory Committee (SPAC) plans to respond to any further developments on the SEC’s proposed climate disclosure rule or other climate-related regulatory proposals affecting CRE.

# # #