Roundtable-Supported Measure Will Promote Job-Creating Projects by Clarifying CRE Acquisition, Development and Construction (ADC) Regulations

(WASHINGTON, D.C.) — Financial deregulation legislation (S. 2155 ) passed today by the House of Representatives (258-159) includes significant reforms to the Basel III High Volatility Commercial Real Estate (HVCRE) Rule that will lower financing barriers for job-creating projects that bring positive investment to local communities throughout the country.

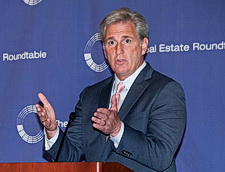

Today’s Dodd-Frank reform legislation, previously passed by the Senate in March, is expected to be signed by President Trump this week. Real Estate Roundtable President and CEO Jeffrey DeBoer noted the years of legislative effort to pass the Economic Growth, Regulatory Relief, and Consumer Protection Act. “The HVCRE reforms included in this bill will help ensure that important real estate construction activities are funded, which is positive for local job creation and economic growth,” DeBoer said.

He added, “The Roundtable recognizes the diligent efforts of policymakers who worked to eliminate the needless regulatory confusion and increased borrowing costs that impeded Acquisition, Development and Construction (ADC) lending. We recognize the dedication of congressional leadership in the Senate and House, including Senate Banking Committee Chairman Mike Crapo (R-ID) and House Financial Services Committee Chairman Jeb Hensarling (R-TX), for their work to pass S. 2155 – and we look forward to President Trump’s signature on this important legislation,” DeBoer said.

The bipartisan HVCRE measure originally was co-sponsored by House Financial Services Committee members Robert Pittenger (R-NC) and David Scott (D-GA) as the Clarifying Commercial Real Estate Loans bill (H.R. 2148) – and passed the House by voice vote in November of last year. The Senate Banking Committee then took up an identical HVCRE bill (S. 2405) co-sponsored by Senators Tom Cotton (R-AR) and Doug Jones (D-AL), which passed in March as part of the Senate’s broader Dodd-Frank reform legislation (S. 2155). Today’s passage by the House of S. 2155 / H.R. ?? includes the same language and clarifications to the Basel III High Volatility Commercial Real Estate (HVCRE) Rule.

The new measure addresses key deficiencies in the agencies’ current and proposed regulations by providing the following modifications and clarifications to either an HVCRE or High Volatility Acquisition, Development or Construction (HVADC) loan:

- Commercial borrowers will be able to satisfy the 15% equity requirement through the appreciated value of contributed land/property – versus the cost basis under the current rule.

- A new exemption would be added to the HVCRE rule covering acquisition/refinancing loans for performing income producing properties. It clarifies that loans made to acquire existing property with rental income and/or do cosmetic upgrades and other improvements don’t trigger the capital penalty.

- Allows borrowers to use internally generated capital in the project and, once the development/construction risk period has passed, outside the project, rather than forcing them to refinance the loan (possibly away from the original lender).

- All ADC loans made prior to January 2015 would be grandfathered and do not have to satisfy current HVCRE exemption criteria.

- Banks would able to withdraw HVCRE status prior to the end of an ADC loan’s term.

The Real Estate Roundtable’s HVCRE Working Group, co-chaired by Sullivan and Worcester Partner Joseph Forte, and PNC Real Estate Senior Vice President William Lashbrook, played a key role in advancing these reforms since 2015.

Forte said, “This legislative action is a welcome solution to a poorly designed regulatory capital scheme that was not matched with risk. This caused an unnecessary cost burden to all commercial banks and their real estate development customers. In addition, it restores to borrowers the ability to offer appreciated land value as equity to banks, when validated through appraisal practices established in earlier statutes. In clearly defining HVCRE exposures, this legislative solution halts the regulatory experimentation in creating pools of commercial real estate development risk, including last year’s HVADC trial balloon of a use of proceeds test on unsecured transactions, requiring capital support where it did not exist. ”

The Roundtable and twelve other real estate organizations on March 2, 2018 sent a comment letter detailing the industry’s HVCRE policy positions and urging inclusion of the HVCRE reforms in a broader Dodd-Frank reform package (S. 2155).