The increasing cost burden of rental housing is now reaching middle-income Americans, according to a Harvard University Joint Center for Housing Studies (JCHS) report, America’s Rental Housing 2020. Federal Reserve Bank of Minneapolis President and CEO Neel Kashkari introduced the report at a Jan. 31 event. “We need a lot more private sector development to come in, build many, many more units across the spectrum, create more supply, that’ll make things more affordable for everyone. Unless we unlock the private sector, we’re never going to help the vast majority of people who are struggling with affordability today,” Kashkari said. (KSTP video, Jan. 31)

- Kashari noted the challenge is how to encourage the private sector to create and preserve affordable housing alternatives at scale so that other targeted government programs can also do their part. “Our research has shown, as many others have shown, that if the private sector builds more units, even market-rate units, it adds supply to a city or region that ends up creating space for everybody, Kashkari said. (YouTube video of JCHS event and ULI’s Urban Land Magazine, Feb. 5)

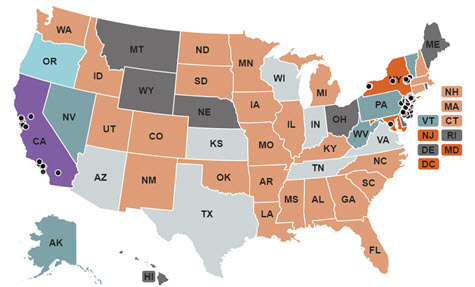

- The latest research from Harvard shows rising rental demand and constricted supply have reduced the stock of low- and moderate-cost units. This shift has significantly altered the profile of the typical renter household, resulting in a growing number of renters with incomes between $30,000 and $75,000 paying more than 30 percent of their income for housing – meeting the definition of “cost-burdened.” (JCHS interactive map of the U.S.).

- The report also notes that the rising cost of affordable rentals has resulted in a majority of lower-income renters spending more than half of their monthly income on housing – conditions that have led to increases in homelessness, particularly in high-cost states. (Bloomberg, Jan. 31 and JCHS chart)

- According to the JCHS, climate change also poses a threat to the stability of American renter households. Between 2008 and 2018, 10.5 million of the country’s 43.7 million renter households live in zip codes that incurred at least $1 million in home and business losses due to natural disasters. Additionally, 8.1 million renter households report that they do not have the financial resources to evacuate their homes if and when a disaster strikes.

- The report’s Executive Summary concludes, “Local governments have found themselves on the front lines of the rental affordability crisis. In response, many jurisdictions have adopted a variety of promising strategies to expand the affordable supply, including increased funding and reform of zoning and land use regulations to allow higher-density construction. Organizations ranging from hospitals and universities to tech companies have also started to address the crisis. Ultimately, though, only the federal government has the scope and resources to provide housing assistance at a scale appropriate to need.” (PDF of entire JCHS report)

Industry Response

The Real Estate Roundtable’s recently released 2020 Policy Agenda addresses affordable housing challenges facing the nation’s communities. The policy agenda states, “The Roundtable aims to galvanize policy makers and like-minded real estate organizations around a set of pro-housing recommendations designed to increase the dearth of affordable units across the nation. ‘One-sizefits-all’ rent control mandates and anti-eviction laws will only further distort the housing supply-and-demand curve without addressing the underlying conditions that create market shortages in the first place.”

- The Roundtable recommends more enduring solutions, such as:

- Federal grants could put a premium on local commitments to high-density zoning, the expansion of by-right multifamily zones, transit-oriented growth and affordable housing.

- Ensure that banks receive “credit” under the Community Reinvestment Act for lending to middle class families.

- Support the production of manufactured housing.

- Free up under-utilized federal properties for affordable housing development.

- Consider the impact of student loan debt on federally-backed mortgage qualification.

- Short-term housing rentals must be regulated to combat long-term housing shortages.

- Federal grants could put a premium on local commitments to high-density zoning, the expansion of by-right multifamily zones, transit-oriented growth and affordable housing.

- The Roundtable also remains focused on legislative and regulatory action that will increase the availability of housing, like a more robust low-income housing tax credit program from Congress and a plan to reasonably reform Fannie Mae and Freddie Mac. On Jan. 21, The Roundtable submitted a suite of policy suggestions to the Department of Housing and Urban Development (HUD) to improve access to affordable housing. (Roundtable Weekly, Jan. 17)

- The Roundtable’s comments to HUD offer policies intended to bring more safe, decent, and affordable housing within reach of indigent and low-income households. It also urges HUD to focus on the scarcity of homes accessible to middle class families, and recommends policies to increase both purchase and rental options for teachers, first responders, and other contributors in America’s workforce.

During The Roundtable’s State of the Industry meeting last week in Washington, DC, a discussion of housing availability and affordability featured Federal Housing Finance Agency Director Mark Calabria and Rep. Patrick McHenry (R-NC), Ranking Member of the House Financial Services Committee. (Roundtable Weekly, Jan. 31)

# # #