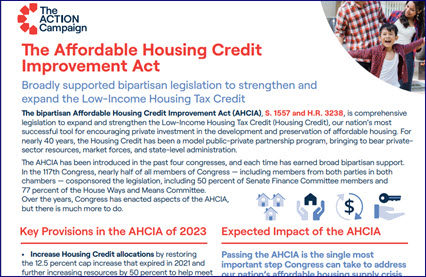

Bipartisan, bicameral legislation introduced last Thursday would significantly expand and improve the low-income housing tax credit (LIHTC). The tax credit, strongly supported by The Real Estate Roundtable, subsidizes the construction, rehabilitation, and preservation of affordable rental housing for low- and moderate-income tenants.

Increasing Supply

- The Affordable Housing Credit Improvement Act (AHCIA) would finance nearly two million affordable homes over the next 10 years. (Affordable Housing Tax Credit Coalition, 2023)

- Led by Sens. Maria Cantwell (D-WA) and Todd Young (R-IN), along with Reps. Darin LaHood (R-IL) and Suzan DelBene (D-WA), the AHCIA (H.R. 3238 and S. 1557) has already garnered nearly 90 cosponsors.

- Roundtable President and CEO Jeffrey DeBoer said, “The low-income housing tax credit is a critical and well-designed tool that addresses a pressing issue throughout the country–the lack of affordable rental housing. LIHTC harnesses market forces and the power of the private sector to incentivize the construction and rehabilitation of affordable homes. Countless studies have demonstrated LIHTC’s cost-effectiveness. Inflation has taken a toll on working Americans, but Congress can help reduce the burden of high housing costs by passing the AHCIA reforms.”

- A March 7 Senate Finance Committee hearing showed bipartisan policymaker consensus on the need to increase the supply of affordable housing by expanding the LIHTC and other tax incentives. The National Multifamily Housing Council (NMHC) and National Apartment Association (NAA), two key supporters of the AHCIA, offered joint testimony during the hearing. (Roundtable Weekly, March 10)

AHCIA Provisions

- A summary of the AHCIA is available here. Among its many provisions, the legislation would:

- Boost the allocation of low-income housing credits to states by restoring the temporary 12.5% increase enacted in 2018 (expired at the end of 2021) and phasing in a 50% increase in the LIHTC allocation cap over two years.

- Lower the threshold of private activity bond financing—from 50 to 25%—required to trigger the maximum amount of 4% housing credits available to individual properties.

- The bill would also ensure that low-income housing credit projects that seek to maximize their energy efficiency through use of the section 179D commercial building deduction are not penalized by existing provisions of the law that reduce the basis of the development by the 179D deduction amount.

- This change would conform the LIHTC/179D rules to be consistent with those that apply to LIHTC and other energy tax incentives, such as the section 48 investment tax credit. (See the bill’s section 309, page 31 and The Roundtable’s Fact Sheet: “IRA Clean Energy Tax Incentives Relevant to U.S. Real Estate”, April 6)

- While movement on LIHTC legislation is unlikely before the debt ceiling debate is resolved, the broad-based, bipartisan support for AHCIA could lead to Congressional action on the bill later in the year. (News – The Affordable Housing Tax Credit Coalition)

Domestic Content

- In related news, the Internal Revenue Service (IRS) released a notice this week on “made in the USA” guidance that can increase clean energy tax credits. The Inflation Reduction Act (IRA) offers a “bonus” tax credit of up to 10% for solar, wind, battery storage, and other projects that use iron, steel, and components manufactured in the U.S. (JD Supra, May 16)

The “domestic content” notice provides initial guidance until the Treasury Department proposes rules on the subject. A fact sheet prepared by The Roundtable keeps track of various federal agency actions that implement IRA tax incentives of significance to the real estate sector.

# # #

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “