A recent Moody's Analytics report compares the amount of commercial real estate loans held by small and regional banks today to CRE asset exposures during the Global Financial Crisis of 2008, concluding that credit positives in the current environment present a more manageable downcycle for CRE and its lenders than 15 years ago. The Roundtable continues to urge federal regulators to issue guidance as soon as possible that would give greater flexibility to lenders for restructuring commercial real estate loans with borrowers.

CRE Exposure

- Nearly $1.5 trillion in CRE loans will mature over the next three years, over half of which is held by commercial banks, according to a separate Morgan Stanley analysis. (Bloomberg, April 8)

- The report from Moody’s acknowledges that higher interest rates currently threaten CRE loans, especially for maturing loans backed by struggling assets. Yet the banking sector has seen recent positive signs, including controlled and strategic borrowing, along with stable deposit levels among small banks.

- The Moody's analysis also notes that CRE loans today have less leverage, asset pricing has more cushion, and borrowers have a more diverse set of debt sources, which puts the CRE debt market in a relatively better position when compared to a 2008-style bank liquidity crunch. (Axios, April 12 and CNBC, April 9).

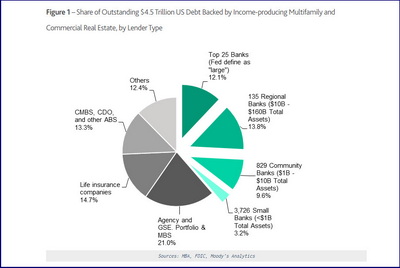

- In the chart above, the Moody’s report clarifies that 13.8% of debt on income-producing properties is held by 135 US regional banks, generally considered as those with about $10 billion to $160 billion in assets. The top 25 banks considered large by the Federal Reserve hold 12.1%. Additionally, 829 community banks (with $1 billion to $10 billion of assets) hold 9.6%, and the remaining 3.2% is spread among 3,726 very small local banks with less than $1 billion in assets. (GlobeSt and Commercial Observer, April 7)

- Kevin Fagan, director of commercial real estate analysis at Moody's Analytics told CNBC, “There's a lot of headaches about calamity in commercial real estate. There likely will be issues but it's more of a typical down cycle.” Fagan also told Axios, “there's definitely been an overreaction in the market about the relationship between banks and CRE.”

Roundtable Request to Regulators

- A March 17 Roundtable letter to federal regulators cited market uncertainty from regional bank turmoil—along with a steady increase in looming debt maturities, rising interest rates, and remote work’s negative influence on office space demand—as coalescing factors that have put pressure on liquidity and decreased refinancing options for CRE assets.

- The Roundtable continues to urge federal regulators to issue guidance that would give financial institutions increased flexibility to refinance loans with borrowers and lenders—similar to other initiatives in 2009, 2010, 2020, and as proposed in 2022. (Roundtable letter to regulators, March 17)

- The Roundtable also urged bank regulatory Agencies to avoid any pro-cyclical policies, such as requiring financial institutions to increase capital and liquidity levels to reflect current mark to market models. “These policies would have the unintended consequence of further diminishing liquidity and creating additional downward pressure on asset values,” the letter states.

- Last week, Roundtable President and CEO Jeffrey DeBoer discussed capital concerns affecting commercial markets on the Walker Webcast with National Multifamily Housing Council President Sharon Wilson Géno and Roundtable Member Willy Walker (Chairman & CEO, Walker & Dunlop). (Roundtable Weekly, April 7)

DeBoer noted during the webcast that “The concept of additional regulations and expanding liquidity are kind of counter to each other. [The banking crisis] has to be allowed to settle through and transition. We ought to be working together and the federal government ought to be helping people transition to that new world.” (Walker Webcast, April 6)

# # #