The House of Representatives’ Democratic majority is expected to pass tonight the largest financial stimulus bill in U.S. history to combat the ongoing economic fallout related to the coronavirus pandemic. (H.R. 6800, Health and Economic Recovery Omnibus Emergency Solutions Act [“HEROES”] Act: one-pager; section-by-section; state and local relief summary.)

- The $3 trillion HEROES Act is considered a marker for Democratic priorities in negotiations with the Republican-controlled Senate and the White House. The bill has been declared “dead on arrival” by Senate Majority Leader Mitch McConnell (R-KY). (The Hill, May 12)

- Since March, Congress has passed four Covid-19 response packages totaling $2.9 trillion. (Roundtable Weekly March 6, March 20, March 27, and April 24)

- President Trump said he is in “no rush” to negotiate another financial rescue bill, while McConnell doesn’t plan to move forward on another economic relief bill until June at the earliest, according to a Senate Republican aide. (Time-AP, May 9 and Bloomberg, May 13)

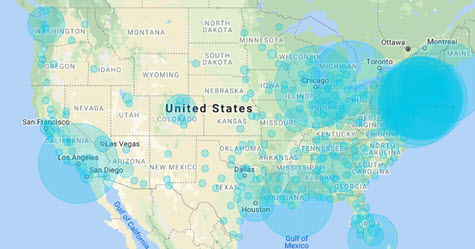

- The HEROES Act would combine $950 billion in aid to state and local governments with direct cash payments, expanded unemployment insurance, support for health care testing and food stamps – along with funding for a list of non-virus related measures such as the U.S. Postal Service and vote-by-mail initiatives. (Forbes, May 12).

- The HEROES Act would also temporarily eliminate the limitation on the deduction for State and local taxes, which was originally passed in 2017’s Tax Cuts and Job Act. (Associated Press, May 12 and CBS News, May 13)

Proposed Legislative Changes to the Paycheck Protection Program

The House bill also includes revisions to the Paycheck Protection Program (PPP) although it does not seek additional funding for more small business loan capacity.

- The HEROES Act would remove the cap that no more than 25% of PPP loan amounts could be forgiven for non-payroll business expenses, such as rent or mortgage interest. On May 11, Treasury Secretary Steven Mnuchin told CNBC the Trump administration is sympathetic to changing the so-called “75/25 rule” that 75% of PPP proceeds must be used for payroll and benefits. “We will look at a technical fix,” Mnuchin said. (CNBC transcript, May 11)

- The Roundtable’s 8-Point Plan to Reform the PPP recommends that Treasury and the Small Business Administration (SBA) should not apply a 75/25 rule as a categorical “one size fits all” standard that limits PPP assistance to help business meet their rent obligations and pay other ordinary operating expenses.

- The HEROES ACT would also change the PPP requirement that the “forgiveness” period for loans would extend to 24 weeks after origination (from the March 27 CARES Act’s current 8-week limitation). (House Small Business Committee summary of the proposed changes to the PPP program and EY Tax News, May 13)

- In other PPP news, a federal court in Michigan declared SBA’s “Ineligibility Rule” invalid in a broad ruling that respects the CARES Act’s text that Congress intended for “any business” with 500 employees or less to be eligible for PPP loans. (May 11 decision in DV Diamond Club of Flint LLC v. SBA, E.D. Mich., No. 20-cv-10899)

- Treasury and SBA release updated rules and guidance implementing the PPP on an ongoing basis. (U.S. Treasury’s PPP resources page)

Federal Reserve Chair Powell Supports More Fiscal Relief

Federal Reserve Chair Jerome Powell on May 13 gave remarks on current economic issues, warning that a prolonged recession could take hold unless additional fiscal aid was devoted to bolster the economy as it reels from the impact of the coronavirus pandemic. (Video of Powell’s remarks)

- Powell noted Congress has already provided $2.9 trillion to battle a downturn “without modern precedent, significantly worse than any recession since World War II.” He added, “While the coronavirus economic shock appears to be the largest on record, the fiscal response has also been the fastest and largest response for any postwar downturn.”

- The Fed has also taken action with “unprecedented speed and force” by slashing interest rates and purchasing Treasuries and agency mortgage-backed securities to restore functionality in critical markets.

- He warned these actions may not be enough, stating that there is “a growing sense … that the recovery will come more slowly than we would like. We ought to do what we can to avoid these outcomes, and that may require additional policy measures.”

- Powell drew attention to policy makers’ next steps in Washington since “the recovery may take some time to gather momentum, and the passage of time can turn liquidity problems into solvency problems.”

As Congress begins its debate over the next coronavirus package, the Fed Chairman concluded his remarks by stating, “Additional fiscal support could be costly, but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery. This tradeoff is one for our elected representatives, who wield powers of taxation and spending.”

# # #