Bipartisan legislation reintroduced this week by House Ways and Means Committee Members Darin LaHood (R- IL) and Brad Schneider (D-IL) would allow real estate investment trusts (REITs) to make greater equity investments in retail tenants that have yet to recover from the pandemic’s economic impact.

Support for Retail Tenant Assistance

- The Retail Revitalization Act (H.R. 3749) is aimed at unlocking capital for productive investment and helping prevent further large-scale job losses and bankruptcies in the retail sector and its supply chain. (Congressional Record, May 30)

- As of May 5, ten major retailers had filed for bankruptcy protection in 2023. The number of retail failures, which includes Bed Bath & Beyond, David’s Bridal, and Party City, is already twice the level of 2022. More bankruptcies are anticipated. (Forbes, May 5 and Forbes, May 15)

- Real Estate Roundtable President Jeffrey DeBoer stated, “The Retail Revitalization Act would reform an outdated section of our tax code that currently prevents the commercial real estate industry from stepping forward and deploying its own capital to solve significant economic challenges. Retail bankruptcies have negative consequences for employees, surrounding businesses, and local communities. This bipartisan legislation to allow REITs to invest more heavily in their tenants is exactly the type of cost-effective, commonsense measure that everyone can and should support. The bill will save jobs, increase local tax revenue, and create a stronger foundation for future economic growth.”

Amending REIT Rules

- The LaHood-Schneider legislation—strongly supported by The Real Estate Roundtable—would modify tax provisions limiting REITs’ ability to invest equity capital in their retail tenants. The bill would amend existing “related-party rent” rules by:

- increasing the capacity of a REIT to own the equity of a distressed tenant from 10% to 50% and from 10% to 30% for all other tenants;

- changing the ownership attribution rules used to determine what is considered related party rent under current REIT rules to the general ownership attribution rules used elsewhere in the tax code, and;

- changing the limitation on space that a REIT can lease to its taxable REIT subsidiary.

Tax Policymakers

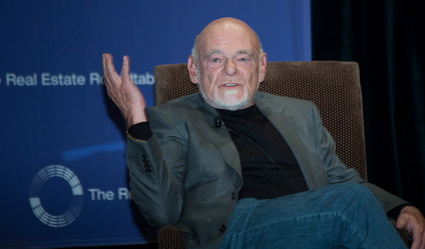

Tax proposals such as H.R. 3749 and others will be discussed during TPAC, held in conjunction with The Roundtable’s all-member Annual Meeting on June 13-14 in Washington, DC. TPAC speakers will include:

Tax proposals such as H.R. 3749 and others will be discussed during TPAC, held in conjunction with The Roundtable’s all-member Annual Meeting on June 13-14 in Washington, DC. TPAC speakers will include:

- House Ways and Means Committee Chairman Jason Smith (R-MO), above

- House Ways and Means Committee Member Brad Schneider (D-IL)

- Joint Committee on Taxation Chief of Staff Thomas Barthold

- Senior staff from Senate Finance Committee and House Ways and Means Committee

TPAC will also feature a panel session on “Post-Pandemic Real Estate Challenges and Tax Policy: Debt Workouts / Tax Incentives for Property Repurposing, Community Revitalization, and Housing.” All Roundtable members are encouraged to attend.

# # #