How national tax policies may affect commercial real estate and the outlook for market sectors were the focus this week of a CBRE podcast, “High Hopes: Why Commercial Real Estate Is Poised for Continued Growth in 2022” that included Roundtable Senior Vice President & Counsel Ryan McCormick.

Tax Policy Issues

- McCormick emphasized that tax increase proposals affecting CRE could receive renewed attention in 2022 if the President, congressional leaders, and key centrist Democrats sit down to renegotiate major elements of the Build Back Better Act. (CBRE Podcast, Jan. 11)

- “We started last year with a tremendous amount of potential change on the table, potential risks for real estate,” including “changes to the taxation of capital investment, capital formation, capital gains . . . pass-through rates and just rates generally,” McCormick noted. In his initial budget, the President proposed “limiting like-kind exchanges, eliminating the step-up in basis of assets at death, and other changes,” he added.

- As the process unfolded, according to McCormick, the real estate industry was able to demonstrate the negative impact these proposals “would have on not just real estate in particular, but local communities, local governments, property tax revenue at the state and local level and the jobs that flow from those industries and those services that are provided.” (CBRE Podcast, Jan. 11)

- Congressional lawmakers, driven by the need to get the key approval vote of Sen. Joe Manchin (D-WV) in an evenly divided Senate, are likely to pare back the cost of the $1.75 billion BBB bill to restart negotiations. (Roundtable Weekly, Jan. 7)

- McCormick added, “The Build Back Better Act is hanging by a thread at this point, and it’s really going back to the drawing board. . . . There’s a lot of different ways and directions things could take. They could go small. They could try to do something on a bipartisan basis. I think the most likely scenario is they whittle back the Build Back Better Act further from where it is today. . . . [I]n many respects, we’re back where we started in 2021.”

The SEC, OZs and SALT

- The discussion also touched on the growing influence of ESG factors on the industry, including the expectation that the Securities and Exchange Commission (SEC) may release a proposed rule for reporting financial risks related to climate during the first quarter of this year. (Roundtable Weekly, Oct. 1, 2021)

- McCormick expressed optimism that political support for Opportunity Zones, which have raised over $75 billion in capital since their enactment in 2017, would grow over time. The Roundtable and other stakeholders recently urged Congress to extend deadlines for investors to qualify for OZ tax benefits. On Thursday, Senate Finance Committee Chairman Ron Wyden announced an investigation into the impact of OZs on jobs and investment in low-income communities (Roundtable Weekly, Jan. 7; Wyden press release, Jan. 13)

- The fate of the deductibility of state and local taxes (SALT) was also a topic in the CBRE podcast.

Roundtable Speakers: Thune, Kerry and Summers

- Tax policy in the new year will be a focus of The Roundtable’s Jan. 25 State of the Industry Meeting (remote) and its Tax Policy Advisory Committee (TPAC) meeting on Jan. 26.

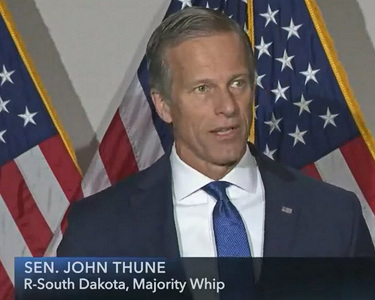

- Featured speakers at The Roundtable’s business meeting will include: Sen. John Thune (R-SD), the number two position in Senate Republican leadership;

John Kerry, President Biden’s Special Envoy for Climate and former Secretary of State; and

Larry Summers, former Secretary of the Treasury and former Director of the White House National Economic Council.

Looking Ahead

- The Jan. 11 CBRE podcast – moderated by Spencer Levy, CBRE’s Global Chief Client Officer & Senior Economic Advisor and co-chair of The Roundtable’s Research Committee – also featured Richard Barkham, CBRE’s Global Chief Economist, Head of Global Research & Head of Americas Research. Barkham focused on the economic outlook and forecasts for capital markets and individual CRE sectors. (GlobeSt, Jan. 12)

- CBRE’s recently released publication, U.S. Real Estate Market Outlook for 2022, projects a growing U.S. economy will fuel demand for space and increase real estate investment across all property types – despite uncertainty from the omicron variant and other risks.

The Real Estate Roundtable’s Policy Agenda for 2022, scheduled for release at the end of this month, will address the tax issues above and several more of importance to CRE in the areas of infrastructure, sustainability, capital and credit, and homeland security.

# # #