On Thursday, The Real Estate Roundtable (RER) wrote to U.S. Treasury Secretary Scott Bessent encouraging the Treasury Department to withdraw regulations issued last year under the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA). (Letter)

Why It Matters

- FIRPTA imposes capital gains tax on foreign investors that invest in U.S. real estate. The discriminatory tax does not apply to any other asset class.

- For several years, RER and other stakeholders have worked with policymakers to reform FIRPTA and remove tax barriers that deter capital formation and investment in U.S. real estate and infrastructure. In 2015, those efforts led Congress to enact a new exemption from FIRPTA for foreign pension funds and other helpful FIRPTA reforms.

- In April 2024, however, Treasury issued final regulations that expanded the reach of FIRPTA to common investment structures by redefining what constitutes a domestically controlled entity.

- The 2024 regulations invented a new look-through rule to determine whether an entity is a domestically controlled REIT exempt from tax under FIRPTA. The practical effect of the regulations is to subject more foreign investors to U.S. taxation and impede capital formation for job-creating U.S. real estate and infrastructure projects (Roundtable Weekly, July 2024)

Roundtable Advocacy

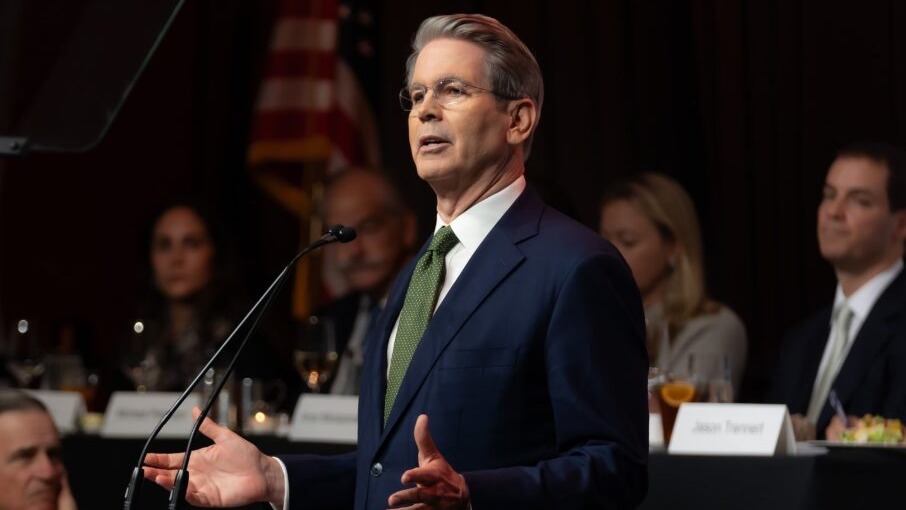

- In a cover letter accompanying a more detailed legal and economic analysis, RER President and CEO Jeffrey DeBoer wrote this week that in issuing the new look-through rule, “Treasury reached well beyond its regulatory authority and invented a rule that contradicts the statute and is damaging the U.S. real estate market.” (Real Estate Group Seeks Withdrawal of Look-Through Rule, Tax Notes March 20)

- “[T]he Look-Through Rule reversed decades of well-settled tax law, severely misconstrued the statute, and contradicted Congressional intent,” wrote DeBoer.

- The letter described the economic benefits of inbound real estate investment. “When invested in U.S. real estate, foreign capital puts contractors, tradesmen, and others to work constructing, upgrading, and improving properties. Pooled with U.S. partners and their expertise, foreign investment helps create productive assets, such as shopping centers and apartment buildings, which revitalize communities and increase the supply of affordable housing.”

- This week’s letter follows repeated efforts by RER and others to stop the regulations from moving forward during the Biden Administration. House Ways and Means Committee Members Darin LaHood (R-IL) and Carol Miller (R-WV) urged former Treasury Secretary Janet Yellen to drop the regulations when they were in proposed form. (Roundtable Weekly, Aug. 2023)

- The legal case against the FIRPTA regulations is even stronger today, in the wake of the Supreme Court’s Loper Bright decision in which the Court significantly narrowed the deference to which regulatory agencies are entitled when rulemaking.

- RER’s submission included a detailed legal and economic analysis prepared by RER’s Tax Policy Advisory Committee FIRPTA Working Group and principally drafted by TPAC Members David Polster and Nickolas Gianou of Skadden, Arps, Slate, Meagher & Flom LLP. (Analysis)

In addition to seeking formal withdrawal of the April 2024 regulations, the letter urges the Treasury Secretary to issue sub-regulatory guidance immediately that would allow taxpayers to rely on the forthcoming withdrawal before it is finalized. The Trump Administration has prioritized removing regulations that unnecessarily impede economic activity.