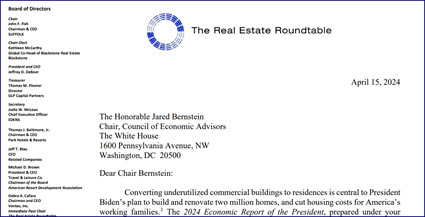

The Real Estate Roundtable urged the Biden administration to take a series of actions to support commercial-to-residential property conversions in an April 15 letter to Jared Bernstein, chair of the White House Council of Economic Advisors. (see Meeting story above)

Improving Agency Resources

- The Roundtable’s letter aims to harness various federal loan programs and tax incentives to provide financial support for CRE conversions.

- A “Commercial to Residential Conversions” guidebook released by The White House last year catalogued various federal resources that could support adaptive re-use projects. (White House fact sheet and Roundtable Weekly, Oct. 27, 2023)

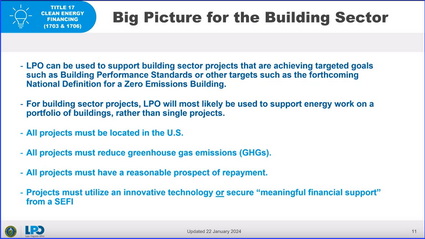

- These programs, enhanced by President Biden’s Bipartisan Infrastructure Law and Inflation Reduction Act, can ideally be tailored to accelerate projects that transform underutilized assets into housing.

- RER’s letter states, “The Federal Guidebook’s featured programs have not lived up to their promise—yet.” The Roundtable’s suggestions to improve these U.S. agency resources support goals to increase housing supply, revitalize urban downtowns, and cut carbon emissions.

Roundtable Recommendations

- The April 15 letter urges agency actions to streamline environmental reviews, hasten the federal loan underwriting process, and layer various agency loan platforms to help finance housing conversions.

- The letter recommends specific improvements to the Department of Transportation’s loan programs for transit-oriented development, which can also resonate for resources offered by HUD, DOE and EPA.

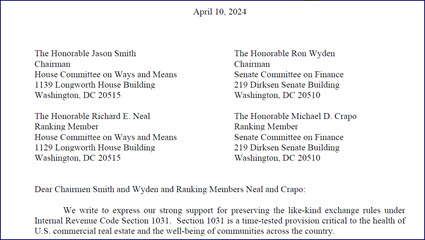

- The Roundtable letter also details changes to the tax code and exisiting incentives that can increase energy efficiency and renewable energy investments in commercial-to-residential building conversions.

The Roundtable will continue to coordinate with White House staff and encourage modifications to federal regulations and laws that can improve CRE conversion projects.

# # #