(WASHINGTON, D.C.) — Industry executives report commercial real estate asset classes continue to face a variety of challenges centered around higher financing costs, increased illiquidity, and uncertain post-pandemic user demand. Reduced transaction volume has also contributed to difficult price discovery, according to The Real Estate Roundtable’s Q4 2023 Sentiment Index.

Roundtable President and CEO Jeffrey DeBoer said, “Commercial real estate is at the front line of change in how people use the built environment in a post-pandemic society. Steep interest rate increases and diminished liquidity caused by regulatory pressures have led to much lower transaction volume and continued uncertainty in price discovery. The challenges facing different asset classes in the broad, complex CRE landscape is reflected in our Q4 Sentiment Index.”

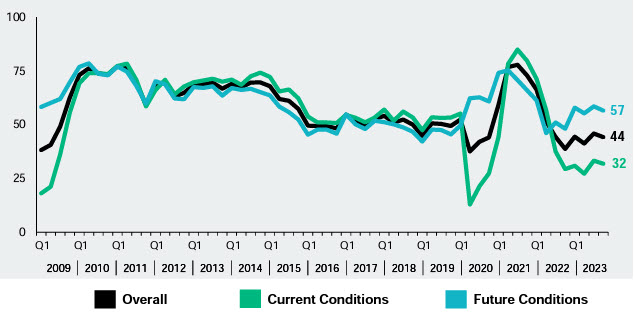

The Roundtable’s Sentiment Index—a measure of senior executives’ confidence and expectations about the commercial real estate market environment—is scored on a scale of 1 to 100 by averaging the scores of Current and Future Sentiment Indices. Any score over 50 is viewed as positive.

The Q4 Sentiment Index topline findings include:

• The Q4 2023 Real Estate Roundtable Sentiment Index registered an overall score of 44, a decrease of two points from the previous quarter. The Current Index registered 32, a one-point decrease from Q3 2023, and the Future Index posted a score of 57 points, a decrease of two points from the previous quarter. These stable indices highlight the persistent challenges faced by participants in the real estate market.

• Although there are variations among asset classes and even within specific property types, ongoing uncertainty within the broader commercial real estate industry persists due to concerns about liquidity, capital availability, interest rates, and remote work. Bright spots exist in smaller classes, such as data centers, outlet malls, and hotels, while multifamily and industrial continue to attract interest. Within the office sector, class “A” properties with top of-the-line amenities are the lone high performers.

• An overwhelming 92% of survey participants indicate that asset values have decreased compared to the previous year. The valuation process has been challenging due to limited transactions, and the combination of current cap rates and fluctuating interest rates has further complicated pricing, ultimately leading to a view that asset values have decreased relative to one year ago.

• Survey participants express ongoing concerns about the capital markets landscape, with 70% indicating that the availability of equity capital has worsened compared to a year ago, and 86% believing the availability of debt capital is also worse.

DeBoer added, “We welcome efforts at all levels of government to incentivize conversions of commercial use to residential use. Yet various CRE markets and asset classes need more time to adapt to the new preferences of clients; more flexibility to restructure their asset financing; and patience while adjusting to the evolving valuation landscape. In addition to conversion activities, The Roundtable continues to urge the federal government to return to the workplace and support measures to assist loan modifications and increase liquidity available to all asset classes and their owners. We also remain opposed to regulatory proposals that impede capital formation.”

Some sample responses from participants in the Sentiment Index’s Q4 Survey include:

“Your perspective depends on what assets you hold and the strength of your balance sheet.”

“The distribution of capital is highly dependent on specific sectors and asset quality.”

“There will be a ‘great revaluation’ cycle with more real estate assets priced lower. There haven’t been enough transactions to collect good data, and the transactions that are happening are in the most dire of circumstances, which is driving erratic and less reliable market information.”

Responses by survey participants reflect recent, persistent challenges facing certain sectors and assets. In comparison to last quarter, sentiments on current conditions are down by 1 point, perceptions of future conditions are down by 2 points, and overall conditions are down by 2 points.

Regarding sentiment on the state of current asset values, 92% of respondents believe they are lower than one year ago, 3% feel they are higher, and 5% believe asset values have remained the same compared to a year ago. This contrasts with the Sentiment Survey one year ago, when only 59% of participants expected asset values would be lower in this Q4 2023, indicating a steep decline in current perceptions of asset values.

Survey participants also commented on the availability of equity capital, with 70% noting it is worse compared to one year ago, 3% stating it has improved, and 27% that the availability of equity remains the same. For the availability of debt capital, 86% of participants believe it is worse compared to one year ago, 2% feel it has improved, and 12% believe the availability of debt remains the same.

Data for the Q4 survey was gathered in October by Chicago-based Ferguson Partners on behalf of The Roundtable. See the full Q4 report.

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.

# # #