House and Senate lawmakers are discussing a short-term stopgap measure aimed at avoiding government shutdown deadlines on Jan. 19 and Feb. 2, which would also buy time to negotiate additional funding through the end of the fiscal year on Sept. 30. Meanwhile, with tax filing season slated to begin Jan. 29, congressional tax writers reported making progress this week on a potential tax package that includes measures on business interest deductibility, bonus depreciation, and the child tax credit. (CQ | PoliticoPro | TaxNotes, Jan. 11)

Funding Challenge

- Sen. John Thune (R-SD), the second-ranking Republican in the Senate, said on Tuesday that a stopgap bill with funding until March might be necessary. “What that looks like next week, and where it originates, House or Senate, remains to be seen.” Thune said. (Roll Call, Jan. 9 and PunchBowl News, Jan. 10)

- Sen. Majority Leader Chuck Schumer (D-NY) announced yesterday that the Senate will consider a “continuing resolution” to keep the government open. “A shutdown is looming over us, starting on Jan. 19, about a week away. Unfortunately, it has become crystal clear that it will take more than a week to finish the appropriations process.” (CBS News and CQ, Jan. 11)

- In the House, Speaker Mike Johnson (R-LA) is struggling to obtain the approval of conservative Republicans on a spending agreement announced on Sunday for a $1.66 trillion spending plan for the federal government. (The Hill, Jan. 11 and AP, Jan. 8))

- Republicans currently hold a 220-seat majority in the House while Democrats control 213, which means Johnson can afford to lose only three votes in his caucus for the GOP to pass legislation in the lower chamber by party-line vote. (AP, Jan 11 | CNN, Jan. 9 | AlterNet, Jan. 2)

Tax Package Negotiations

- On Wednesday, Senate Finance Committee Chairman Ron Wyden (D-OR) and House Ways and Means Committee Chairman Jason Smith (R-MO), above, presented their members with an outline of a potential, three-year $70 billion tax package.

- Disagreements continue over the scope of a potential child tax credit and low-income housing tax credit in exchange for partial restorations of business tax credits such as business interest deductibility and bonus depreciation. (MarketWatch and PunchBowl, Jan. 11 | PoliticoPro and Wall Street Journal, Jan. 10)

- Issues that remain under consideration include a Roundtable-supported expansion of the low-income housing tax credit and the deductibility of state and local taxes (SALT). Sen. Wyden and senior congressional staff will discuss tax legislation with Roundtable members during The Roundtable’s all-member 2024 State of the Industry Meeting on Jan. 23-24.

Preview of Coming Tax Battles

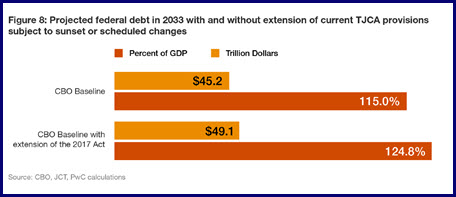

- Current discussions among congressional tax negotiators are a precursor for a much larger challenge next year, when 23 different provisions in the 2017 Tax Cuts and Jobs Act (TCJA) will change or expire at the end of 2025, including the deduction for pass-through business income and the cap on the SALT deduction. (Roundtable Weekly, May 26)

- PWC emphasized the stakes in next year’s tax negotiations in its “2024 Tax Policy Outlook” released yesterday. PwC’s National Tax Services Co-Leader Rohit Kumar told PoliticoPro that the current tax package under consideration would amount to only a “rounding error” when compared to the value of all the TCJA provisions. Today’s Wall Street Journal estimated there are $6 trillion in taxes at stake in this year’s elections.

- Policymakers’ efforts to pass government funding and negotiate a tax package come as office vacancies hit a record high in the fourth quarter of last year, according to a Moody’s Analytics released Jan. 8.

The Moody’s report shows the national office vacancy rate rose 40 bps to a record-breaking 19.6 percent. The new record shatters the previous rate of 19.3% set twice previously—and reflects changing trends in business needs and the recent shift towards in remote work arrangements. (Wall Street Journal and ConnectCRE, Jan. 8)

# # #