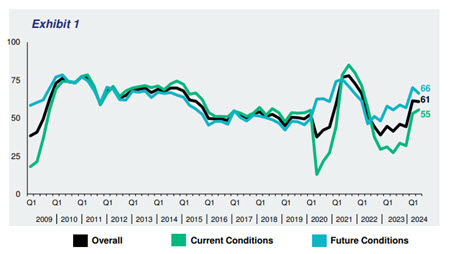

(WASHINGTON, D.C.) — Commercial real estate executives expressed tempered optimism about property markets in The Real Estate Roundtable’s Q2 2024 Sentiment Index as high interest rates and liquidity challenges linger. The Q2 Sentiment Index registered the same overall score of 61 from the previous quarter as uncertainty persists about future asset values and availability of capital.

The Roundtable’s Current Sentiment Index registered 55, a 2-point increase over Q1 2024. The Future Index posted a score of 66 points, a decrease of 4 points from the previous quarter. Any score over 50 is viewed as positive. The Overall Index this quarter of 61—a measure of senior executives’ confidence and expectations about the commercial real estate market environment—is scored on a scale of 1 to 100 by averaging the scores of the Current and Future Indices.

The Q2 Sentiment Index topline findings also include:

- Evolving market trends continue to shape the real estate landscape. A majority (66%) of Q2 survey participants expect general market conditions to show improvement one year from now. Additionally, 45% of respondents said conditions are better now compared to this time last year. Only 11% of Q2 participants expect general market conditions to be somewhat worse in a year, a slight increase from 6% in Q1.

- Class B office properties are facing ongoing challenges, attributed to an ongoing “flight to quality.” Industrial and multifamily sectors show tempered growth, yet their underlying fundamentals remain robust. Retail sectors are healthy, propelled by consumer spending, while interest in data centers continues to ascend.

- A significant 75% of Q2 survey participants expressed optimism that asset values will be higher (44%) or the same (31%) one year from now, indicating some semblance of expected stability.

- The real estate capital markets landscape remains challenging. For the current quarter, 65% believe the availability of equity capital will improve in one year, while 64% said the availability of debt capital will improve in one year. The 36% of participants who said the availability of debt capital would be worse in one year is an increase from 24% in Q1 who voiced the same expectation.

- Regarding sentiment on the availability of equity capital, 65% of survey respondents expect conditions to improve, compared to 26% who stated that availability of equity capital was better a year ago.

Some sample responses from participants in the Sentiment Index’s Q2 survey include:

“Real estate fundamentals are shaping up to be very strong in one to two years. Companies that have a long-term perspective and can be patient will benefit from strong employment growth, demographic shifts, and stable occupancies.”

“The mom-and-pop investors who own class B office are hurting the most. The institutional investors are diversified, so they are faring better.”

“Stability in asset values isn’t just about reaching pre-2022 levels; it’s about establishing a new norm based on sustainable growth.”

Data for the Q2 survey was gathered by Chicago-based Ferguson Partners on The Roundtable’s behalf in April. See the full Q2 report.

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.