The number of office assets facing loan defaults or entering special servicing is growing in major markets as remote work and rising interest rates continue to exert pressures on metropolitan areas and city budgets, according to reports this week in Commercial Observer and Bloomberg.

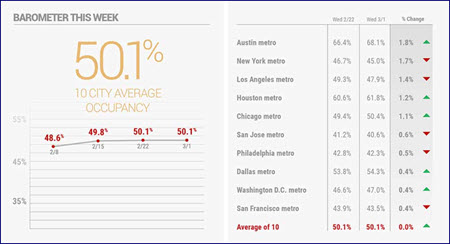

Workplace Occupancy

Congressional Hearings

The Real Estate Roundtable wrote to President Joe Biden last December about the need for federal employees to return to their workplaces—and encouraged the administration to support legislation that could incentivize conversion of underutilized buildings to more productive use such as housing. These two requests are included in the House-approved Stopping Home Office Work’s Unproductive Problems (SHOW UP) Act (H.R. 139). (Roundtable Weekly, Feb. 3 | GlobeSt and CoStar, Dec. 15, 2022)

# # #

The Biden administration yesterday proposed a $6.9 trillion FY2024 budget that includes $3 trillion in deficit reduction and $2.2 trillion in tax increases over the next decade on corporations, high-earning households, and certain business activities, including real estate investment. (White House budget materials and Treasury Department news release)

Blueprint for Negotiations

The Biden administration yesterday proposed a $6.9 trillion FY2024 budget that includes $3 trillion in deficit reduction and $2.2 trillion in tax increases over the next decade on corporations, high-earning households, and certain business activities, including real estate investment. (White House budget materials and Treasury Department news release)

Blueprint for Negotiations

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler commented on March 6 that the agency’s forthcoming rule on climate reporting may be scaled-back, including its proposal for sweeping disclosures on Scope 3 GHG emissions, according to CNBC.

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler commented on March 6 that the agency’s forthcoming rule on climate reporting may be scaled-back, including its proposal for sweeping disclosures on Scope 3 GHG emissions, according to CNBC.

Scope 3 Proposal

Congress Weighs In

A final rule is anticipated from the SEC this spring. The Roundtable’s Sustainability Policy Advisory Committee (SPAC) will continue to track any developments on the agency’s proposed rule and other climate-related regulatory proposals affecting CRE.

# # #

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “Tax Policy’s Role in Increasing Affordable Housing Supply for Working Families.” (NMHC President Sharon Wilson Géno, above and MarketWatch, March 9)

Solutions to Meet the Need

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “Tax Policy’s Role in Increasing Affordable Housing Supply for Working Families.” (NMHC President Sharon Wilson Géno, above and MarketWatch, March 9)

Solutions to Meet the Need