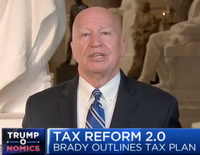

House Ways and Means Committee Chairman Kevin Brady (R-TX) on July 24 outlined a proposed second round of tax cuts to House Republicans, who hope to vote on “Tax Reform 2.0” before the midterm elections..

- Chairman Brady stated. "With this framework, we are taking the first step to change the culture in Washington D.C. where tax reform only happens once a generation. We plan to work off this framework to build on the growing successes of the Tax Cuts and Jobs Act and ensure this energized economy continues moving forward." (House Ways and Means Statement, July 24)

- In an interview with CNBC, Brady expanded on the three core components of the 2.0 proposal:

- making the individual and small business tax cuts enacted by the 2017 Tax Cuts and Jobs Act permanent'

- promoting family savings through retirement accounts, a new universal savings account, and

- expanded 529 education savings accounts; and spurring business innovation by allowing new businesses to write off more of their initial start-up costs, and removing barriers to growth.

- The central feature of the proposal – a permanent extension of tax cuts for individuals – is unlikely to pass the Senate, where it would need Democratic support. (The Hill, July 24)

|

Senior Ways and Means Committee Member Devin Nunes (R-CA) has introduced legislation (H.R. 6444) to index capital gains to inflation – a proposal that would reduce the tax burden on long-lived assets, including real estate. |

- Although House Republicans aim to vote on "Tax Reform 2.0" legislation in September, a tax technical corrections bill may not be voted on until after the November elections. (Roundtable Weekly, July 20)

- Meanwhile, senior Ways and Means Committee Member Devin Nunes (R-CA) has introduced legislation (H.R. 6444) to index capital gains to inflation – a proposal that would reduce the tax burden on long-lived assets, including real estate. An inflation adjustment for capital gains previously passed the House in the 1990s but died in the Senate. House tax-writers may consider indexing capital gains as part of Tax Reform 2.0. (The Hill, July 20)

- Separately, attention this week was focused on a mistake affecting qualified improvement property cost-recovery tax rules. An amendment (# 3597) introduced yesterday by Sen. Pat Toomey (R-PA) to an appropriations bill (H.R. 6147) would correct a drafting error in the Tax Cuts and Jobs Act that unintentionally pushed the recovery period for property improvements from 15 to 39 years. As a result of the mistake, businesses across the country are delaying, or significantly reducing, capital expenditures for building improvements, undermining job creation and economic activity. (BGov, July 26)

- Additionally, the Treasury Department has sent draft regulations regarding the new deduction for pass-through business income to the White House Office of Management and Budget (OMB) for formal review. Under a recent agreement between the two agencies, OMB has 10 days to review the regulations before they are issued, unless the parties mutually agree to extend the review period. (TaxNotes, July 25)

In January, The Roundtable wrote to Treasury Secretary Mnuchin offering several suggestions designed to maximize the economic impact of the pass-through deduction and avoid unnecessary disruptions to business activity. [Roundtable Letter, Jan. 18].