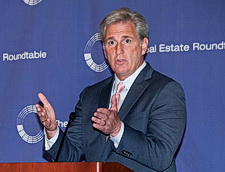

House Majority Leader Kevin McCarthy (R-CA) yesterday said the House will vote on the Senate's Dodd-Frank reform bill (S. 2155), before Memorial Day. S. 2155 includes a measure to reform the Basel III High Volatility Commercial Real Estate (HVCRE) Rule – a top Roundtable priority. (Roundtable Weekly, May 4)

|

House Majority Leader Kevin McCarthy (R-CA) said the House will vote on the Senate's Dodd-Frank reform bill ( S. 2155 ), before Memorial Day. |

- Ryan: GOP has deal on bill easing Dodd-Frank, The Hill (May 8) – House Speaker Paul Ryan (Wisconsin) on Tuesday said the House will hold a vote on the Senate Dodd-Frank reform bill in exchange for the Senate taking up a separate set of financial reform bills supported by House Financial Services Committee Chairman Jeb Hensarling (R-TX) Texas).

- House Speaker Ryan, American Banker (May 8) – "I had a good meeting with [Senate Majority Mitch McConnell] over the break on this and so we've got an agreement to be moving different pieces of legislation."

- Bill to Roll Back Post-Financial-Crisis Banking Rules Gets Clear Path to Passage, Washington Post, May 8 –- As the sponsor of more ambitious Dodd-Frank reforms approved by the House last year, Hensarling said he was confident that the new approach to separate the legislative effort into two bills would "create regulatory policy that will help us achieve sustained 3% economic growth."

|

The Roundtable and 12 other real estate organizations on March 2, 2018 sent a comment letter urging all members of the Senate Banking Committee to enact the HVCRE measure by including the measure in the broader Dodd-Frank reform package (S. 2155). |

HVCRE Reform Measure Included

- (Roundtable Weekly, Jan. 12) – The Senate bill would clarify which types of loans should be classified as High Volatility Commercial Real Estate Loans (HVCRE) to ensure they do not impede credit capacity or economic activity, while still promoting economically responsible commercial real estate lending.

- GlobeSt.com, (March 19) – "The HVCRE rule, promulgated by Basel III, went into effect in 2016. It established a new risk-weight category requiring banks to hold more capital - 150% or one and half times as much - for such loans. The result has been a pull back on construction lending among other types of bank finance."

- Real Estate Industry Comment Letter, (March 2) – The Roundtable and twelve other real estate organizations on March 2, 2018 sent a comment letter urging all members of the Senate Banking Committee to enact the HVCRE measure by including it in the broader Dodd-Frank reform package (S. 2155).

Since 2015, The Roundtable's HVCRE Working Group and industry coalition partners have played a key role in advancing specific reforms to the HVCRE Rule. During next month's Real Estate Roundtable Annual Meeting, HVCRE will be a focus of discussion, with more specific details offered during the Real Estate Capital Policy Advisory Committee (RECPAC) meeting on June 14.