Commercial real estate leaders report positive market fundamentals across asset classes, according to The Real Estate Roundtable’s Q4 2021 Economic Sentiment Index. Industry leaders describe steady supply, demand and financial conditions for multifamily, industrial, life science and other assets while expressing some caution about the strength of office and hotel assets. Leaders also noted conditions vary by geography and local governmental policies.

Topline Findings

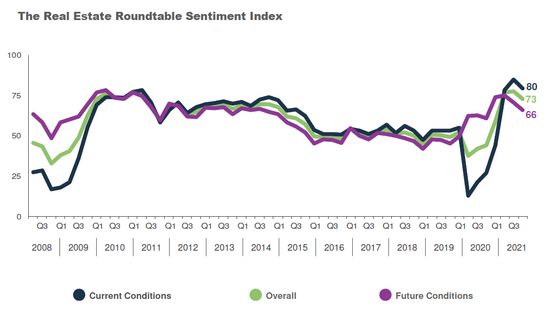

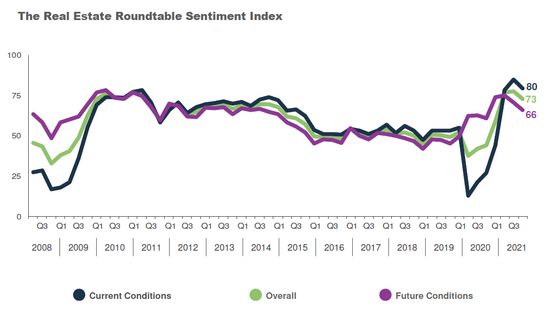

- The Roundtable’s Overall Q4 2021 Sentiment Index registered a score of 73, which reflects continued optimism about general market conditions despite a slight dip of five points from the previous quarter. The Economic Sentiment Overall Index is scored on a scale of 1 to 100 by averaging the scores of Current and Future Indices. Any score over 50 is viewed as positive.

- Roundtable President and CEO Jeffrey DeBoer (above) said, “Our Q4 Sentiment Index score is a 29-point increase over the same time period last year. This is a solid indication of significant progress in the overall economy as more businesses continue to reopen under cautious, local COVID-19 protocols.”

- He added, “CRE leaders are encouraged by the safe (albeit slow) return of employees to their work places, robust retail consumer appetites, and the gradual return of domestic and international travelers to hotels, resorts and other hospitality assets. The commercial real estate industry continues to play an active role in accommodating new business and individual preferences that will help the economy adjust post-COVID.”

- “Industry leaders are concerned with accelerating inflation, supply chain obstacles and still unclear questions regarding future office space desires,” DeBoer noted.

- The Roundtable’s quarterly economic survey also shows that 85 percent of respondents believe that general market conditions today are “much better or somewhat better” versus one year ago – and that 61 percent anticipate conditions will continue to improve one year from now.

- The report’s Topline Findings include:

- The Q4 2021 Real Estate Roundtable Sentiment Index registered a score of 73, a decrease of five points from the third quarter of 2021 and a 29-point increase over Q4 2020. Despite the slight downtick from Q3, participants largely expressed optimism regarding the current fundamentals of the commercial real estate market.

- That said, perceptions vary by property type and geography, with industrial, multifamily, life sciences and data centers most in favor. Delayed return-to-office policies and questions about office space demands have resulted in a degree of uncertainty.

- Asset values have trended upward across asset classes compared to the previous quarter.

- Participants cited a continued availability of debt and equity capital. International investors remain highly interested in opportunities within the United States.

Infrastructure & CRE

- DeBoer also noted, “The recent passage of the $1.2 trillion bipartisan infrastructure bill by Congress will help the commercial real estate industry to ramp up its existing suite of climate-friendly practices by reimagining, building and retrofitting America’s built environment.”

- He added, “The Roundtable is also encouraged that the bill emphasized the expanded use of public-private partnerships to reach infrastructure goals – as well as measures that will streamline the federal permitting process and improve key federal energy data that support EPA building labels.”

Data for the Q4 survey was gathered in October by Chicago-based Ferguson Partners on The Roundtable’s behalf. See the full Q4 report.

# # #