An unexpected agreement announced Wednesday night between Senate Majority Leader Chuck Schumer (D-NY),

above right, and Sen. Joe Manchin (D-WV),

left, on a $790 billion

reconciliation proposal includes $14 billion in increased taxes on carried interest and a 15% corporate minimum tax—in addition to $369 billion in climate spending that affects “clean energy” measures important to commercial real estate.

Senate Democrats are hoping to pass some version of the Schumer-Manchin language on a party-line vote before the upper chamber begins its summer recess on Aug. 8. (Senate Democrats’

joint statement and

one-page bill summary, July 27 |

Committee for a Responsible Federal Budget, July 28)

Legislative Details

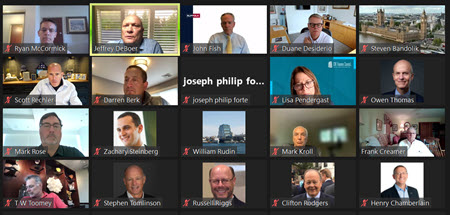

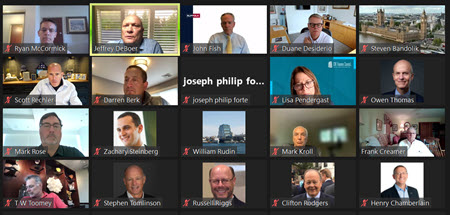

- Today, The Real Estate Roundtable held an all-member virtual town hall to discuss major provisions within the 725-page Inflation Reduction Act (IRA) of 2022. The Roundtable is working with its policy advisory committees and national real estate organization partners to assess how details in the bill language could impact CRE.

- Real Estate Roundtable President Jeffrey DeBoer stated, “The Roundtable is engaged with policymakers and Capitol Hill staff on the potential impact of the proposed bill on real estate capital formation, economic growth, clean energy investments, and affordable housing development. The industry is working together to mitigate any negative consequences for CRE before policymakers hold an eventual vote on a final bill."

Taxes & Clean Energy

- The IRA’s largest tax increase is a new 15% corporate minimum tax on businesses with profits over $1B whose reported book income exceeds reported taxable income. The measure is estimated to raise $313B. The package also includes protections that would preserve the value of the low-income housing tax credit for investors (typically large banks) that use the credit to reduce their effective tax rate.

- The smallest tax increase would raise $14B in revenue by extending the capital gains holding period requirement for carried interest from 3 years to 5 years, although there is an exemption for real estate. Additionally, there are technical reforms to the holding period rules for measuring the 3- or 5-year holding period. (Deloitte Tax News & Views, July 29)

- The carried interest holding period change includes a real estate exception for gain associated with assets used in a real property trade or business. The language in the IRA on carried interest is identical to text in the House Ways and Means Committee’s previous reconciliation bill last year—language that was dropped from the version that passed the full House. (Roundtable Weekly, Sept. 17, 2021)

- The Schumer-Manchin agreement also proposes significant reforms to Section 179D—the tax code’s main provision to incentivize energy efficient commercial buildings. The 179D reforms are geared to encourage more existing building “retrofits” although maximum incentives amounts depend on compliance with heightened wage and labor standards.

- Tax incentives are also included to encourage investments in solar panels, energy storage, and EV charging stations. (See Summary of the bill’s Energy Security and Climate Change Investments)

Timeline

- There are several challenges to the Senate Democrats’ timeline for passage of the bill in early August.

- Senate Democrats need all 50 members of their caucus present for an eventual budget reconciliation vote, along with Vice President Kamala Harris to break an anticipated tie with 50 Republicans. Yet Covid-19 infections have caused recent absences. (The Hill, July 28)

- The bill was sent to Senate Parliamentarian Elizabeth MacDonough to see if it conforms with reconciliation budget rules, a process that will spill over into next week. (BGov, July 29)

- Arizona Democratic Senator Kyrsten Sinema is a key centrist vote, considering she has long opposed changes to the taxation of carried interest. Sinema’s spokesperson Hannah Hurley said yesterday that the Senator is “reviewing the text and will need to review what comes out of the parliamentarian process.” (BGov, July 29)

# # #

An unexpected agreement announced Wednesday night between Senate Majority Leader Chuck Schumer (D-NY), above right, and Sen. Joe Manchin (D-WV), left, on a $790 billion reconciliation proposal includes $14 billion in increased taxes on carried interest and a 15% corporate minimum tax—in addition to $369 billion in climate spending that affects “clean energy” measures important to commercial real estate.

Senate Democrats are hoping to pass some version of the Schumer-Manchin language on a party-line vote before the upper chamber begins its summer recess on Aug. 8. (Senate Democrats’ joint statement and one-page bill summary, July 27 | Committee for a Responsible Federal Budget, July 28)

Legislative Details

An unexpected agreement announced Wednesday night between Senate Majority Leader Chuck Schumer (D-NY), above right, and Sen. Joe Manchin (D-WV), left, on a $790 billion reconciliation proposal includes $14 billion in increased taxes on carried interest and a 15% corporate minimum tax—in addition to $369 billion in climate spending that affects “clean energy” measures important to commercial real estate.

Senate Democrats are hoping to pass some version of the Schumer-Manchin language on a party-line vote before the upper chamber begins its summer recess on Aug. 8. (Senate Democrats’ joint statement and one-page bill summary, July 27 | Committee for a Responsible Federal Budget, July 28)

Legislative Details