Roundtable President & CEO Jeffrey DeBoer was honored this week with the Lamplighter Award by the American Friends of Lubavitch (Chabad), along with Speaker of the U.S. House of Representatives Mike Johnson, for their leadership and dedication to community and service.

Roundtable Leaders’ Comments

Lamplighters

Several hundred people attended the event, reception and dinner, including several Senators and House members; Gold Star families and members of the U.S. armed forces; and nearly two dozen ambassadors.

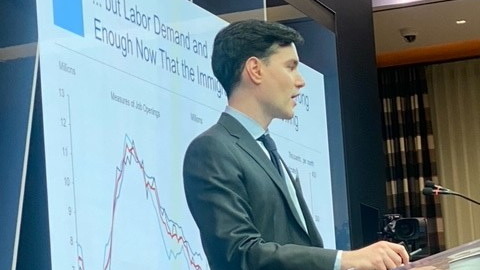

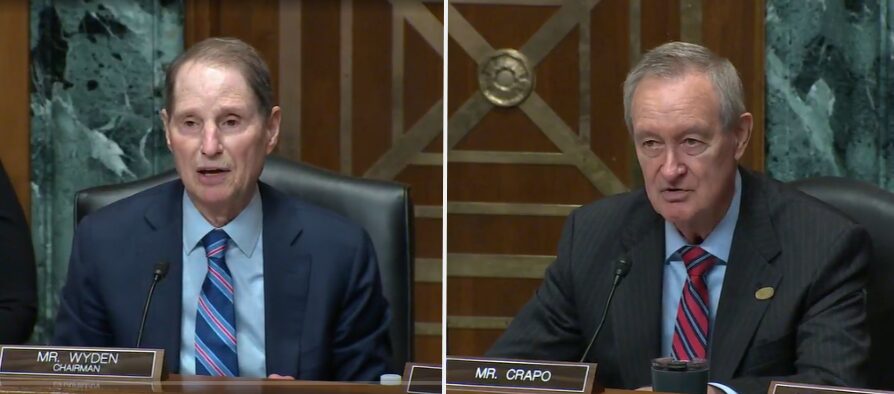

The Senate Finance Committee held a hearing on the 2025 tax policy debate, highlighting sharp divides between Republicans and Democrats over the future of the key provisions of the Tax Cuts and Jobs Act of 2017 (TCJA) that are set to expire in 2025. (Watch Hearing | Bloomberg, Sept. 12)

2025 Tax Policy Debate

199A Coalition

What’s Next

The Roundtable’s Tax Policy Advisory Committee (TPAC) will continue to closely track ongoing tax debates in Congress.

Federal Reserve Vice Chair for Supervision Michael S. Barr previewed the latest revisions to the Basel III Endgame capital requirements this week. Amid industry opposition, Barr scaled back his initial proposal to raise capital requirements for large banks, offering a more measured approach to the rule. (Bloomberg, Sept. 10)

Basel III & CRE

What’s Next

The Roundtable’s Real Estate Capital Policy Advisory Committee (RECPAC) will continue to monitor and respond to any further changes to the Basel III Endgame proposal and other federal policy issues impacting credit capacity and capital formation.