President Joe Biden this week met with a bipartisan group of policymakers about the details of his multitrillion infrastructure proposal as a bloc of moderate GOP senators stated they are developing a far less expensive counterproposal that would pare back the definition of what comprises “infrastructure” and fund it with unspecified user fees. (Washington Post, April 14)

SALT Caucus

Energy-Efficient Buildings

The Roundtable is part of the Build by the 4th coalition, led by the U.S. Chamber of Commerce, which encourages the Biden Administration and Congress to pass a comprehensive infrastructure deal by Independence Day 2021.

# # #Federal Reserve Bank of Dallas President and CEO Robert S. Kaplan, top left in photo, on April 12 discussed a wide range of monetary and fiscal policy issues with Roundtable Chairman Emeritus Robert S. Taubman (Chairman & CEO, Taubman Centers, Inc.), top right, and Roundtable President and CEO Jeffrey DeBoer, center. (Watch the Kaplan video interview on The Roundtable’s YouTube Channel)

The Fed View

Pandemic Relief Funds & Distribution

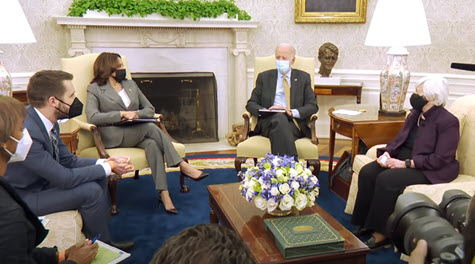

The Treasury Department continues to implement pandemic recovery programs, including the State and Local Fiscal Recovery Fund, State Small Business Credit Initiative, and renter and homeowner assistance. Treasury Secretary Yellen and White House Rescue Plan Coordinator Gene Sperling met yesterday with members of the National Governor’s Association Executive Committee to determine the most efficient and effective way to get federal resources to states. (Treasury Dept readout, April 15)

# # #

The bipartisan Build More Housing Near Transit Act of 2021 (H.R. 2483) – reintroduced on April 14 by Reps. Scott Peters (D-CA) and McMorris Rodgers (R-WA) – would encourage the construction of low and middle-income housing in transit-served, walkable locations.

Benefits of the Bill

Broad Support

Original cosponsors of the legislation include Reps. Marilyn Strickland (D-WA), Derek Kilmer (D-WA), Lisa Blunt Rochester (D-DE), David Scott (D-GA), Ami Bera (D-CA), Alan Lowenthal (D-CA), and Tom Suozzi (D-NY).

# # #

Officials from the Fed and other top federal financial regulatory agencies testified on April 15 before a House Financial Services subcommittee that they support federal legislation to transition away from using the London Interbank Offered Rate (Libor) as an interest rate benchmark for US dollar contracts. (Subcommittee hearing video and background memorandum)

Libor Deadlines

Roundtable Support

The American College of Real Estate Lawyers recently published a detailed overview of the Libor transition – “LIBOR'S Endgame: a Brief Pause, Not a Reprieve; a Safe Harbor, but a New Penalty” – by Joe Forte (Senior Legal Councel, AmTrust Title), who is a member of The Roundtable’s Real Estate Capital Policy Advisory Committee (RECPAC).

# # #