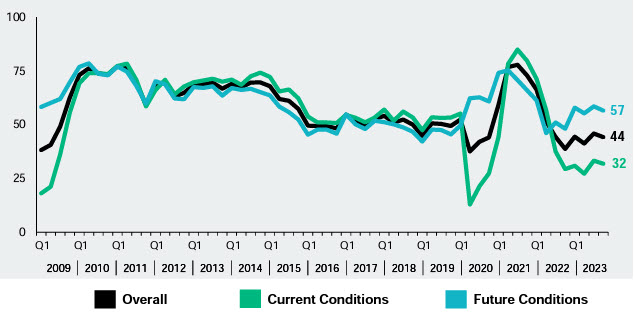

Industry executives report commercial real estate asset classes continue to face a variety of challenges centered around higher financing costs, increased illiquidity, and uncertain post-pandemic user demand. Reduced transaction volume has also contributed to difficult price discovery, according to The Real Estate Roundtable’s Q4 2023 Sentiment Index. (RER news release, Nov. 3)

Pressures on CRE Assets

Q4 Sentiment Index Topline Findings:

“Your perspective depends on what assets you hold and the strength of your balance sheet.”

“The distribution of capital is highly dependent on specific sectors and asset quality.”

“There will be a ‘great revaluation’ cycle with more real estate assets priced lower. There haven’t been enough transactions to collect good data, and the transactions that are happening are in the most dire of circumstances, which is driving erratic and less reliable market information.”

Data for the Q4 survey was gathered in October by Chicago-based Ferguson Partners on behalf of The Roundtable. See the full Q4 report.

# # #

The Real Estate Roundtable submitted comments this week encouraging the Treasury Department to provide a compliance “safe harbor” to streamline labor-related requirements necessary to seek “bonus” tax incentives for clean energy building projects under the Inflation Reduction Act (IRA). (Roundtable comment letter, Oct. 30)

Prevailing Wage and Apprenticeship Compliance Burdens

Contractor Compliance Certifications Sought

Other targeted tax reforms that will help scale real estate’s transformation toward zero emissions are recommended in The Roundtable letter. These include expanding Section 48 of the Code to building electrification technologies; allowing private owner transfers to unrelated third parties under Sections 45L and 179D; and repealing a Section 179D rule that reduces a property’s basis by the amount of the claimed deduction. (Roundtable comment letter, Oct. 30)

# # #

The Real Estate Roundtable urged the Securities and Exchange Commission (SEC) this week to exempt real estate from a proposed Safeguarding Advisory Client Rule that could severely limit advisory clients’ ability to invest by fundamentally changing the ownership and transfer rights of real estate. The proposed rule currently includes a conditional exception for real estate assets, which would impose a new layer of unclear and unnecessary oversight—and inject significant confusion into well-established transaction protections, rules, and procedures governing real estate transactions. (Roundtable letter, Oct. 30 and SEC Proposed Rule)

The “Proposing Release”

“In the real estate context, a deed or similar indicia of ownership that could be used to transfer beneficial ownership of a property would not qualify for the exception, but the physical buildings or land would qualify.”

Existing Layers of Safeguards

The Roundtable’s Real Estate Capital Policy Advisory Committee (RECPAC) Custody Rule Working Group developed this week’s comments and met today with the SEC’s Division of Investment Management about the proposal. RECPAC is scheduled to meet Nov. 8 in New York City.

# # #